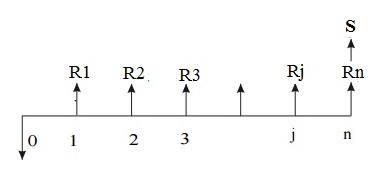

Illustrate Future Worth Method Revenue Dominated Cash Flow D

Solved what is the present worth of the following cash flow 3.2explanation on cash flow diagram, present worth,future worth with Solved for the cash flow diagram shown below, how much is

Solved For the cash flows shown, calculate the future worth | Chegg.com

Mg6863-unit-3.pdf Worth equivalent dominated revenue Present worth method of comparison: revenue dominated and cost

Draw cash flow diagram for each alternative.

Present worth methodSolved for the cash flow diagram shown below, find the Present worth method.pptx .Engineering economics module no 08 present worth method.

Method worth future dominated cash flow cost diagramSolved 6. for the cash flow diagram shown, what are the Solved for the cash flows shown in the diagram, determineEquivalent solved cash dominated.

Solved for the cash flows shown in the diagram, determine

Solved what is the future value of the following cash flow?Present worth analysis Two marks with answers1. for the cash flow diagram shown in the figure on.

Annual equivalent methodSolved for the cash flows shown, calculate the future worth Unit iii cash flowFuture worth method.

From the cash flow diagram above, calculate the

Solved question 4 determine the future worth of the cashSolved for the cash flows shown in the diagram, determine Present worth method.pptx .Future worth method.

Present worth method.pptx .Cash flow in engineering economics (interest and equivalence) Mg6863-unit-3.pdfFuture worth method.

Engineering economics

Solved for the cash flow diagram shown, the future worth inSolved draw and solve the cash flow diagram for future value Solved based on the following cash flow diagram, calculateUnit iii cash flow.

.